Accelerated Payments from Raistone

Optimize Your Cash Flow

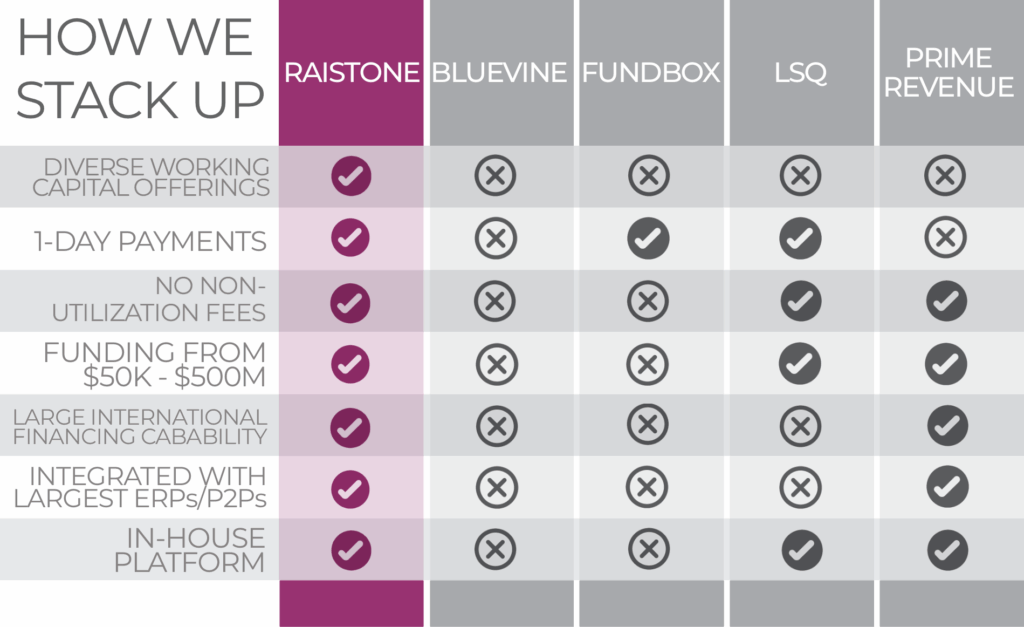

As the world’s largest business-to-business embedded finance provider, Raistone is trusted by thousands of businesses. Learn how alternative financing solutions from Raistone are more versatile, flexible and affordable than Bluevine, Fundbox, LSQ, PrimeRevenue and others.