Working Capital Solutions for Buyers & Suppliers

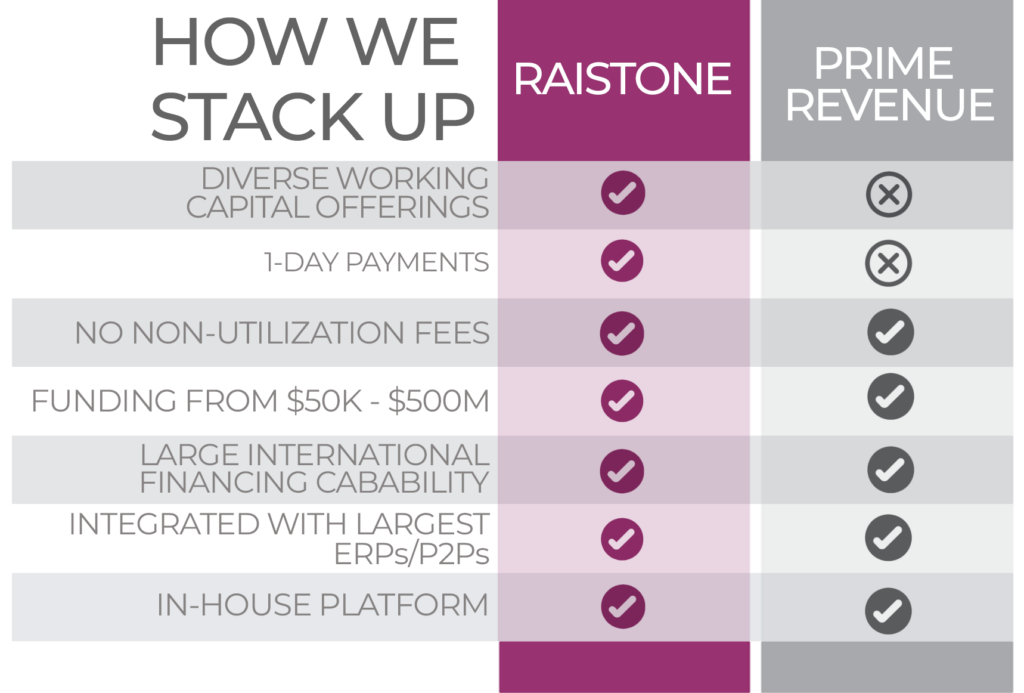

Faster Funding Than Prime Revenue

Raistone provides businesses of all sizes with versatile, flexible and affordable options. Whether you’re a supplier looking for faster cash or a buyer looking for payment term flexibility, Raistone has solutions to help your business. Our diverse funding and ability to facilitate one-day payments provide unprecedented working capital access.