Sections

- Small Business Owners Turning to Innovative Solutions

- A Different Approach to Risk

- SMBs Face Working Capital Squeeze

- Mastercard Virtual Card Collaboration

- Boosting Diversity and Inclusion

- Democratizing Access to Capital

- ARF as a Tool for Growth

- Working Capital Solutions Deliver Results

- Funding Small Business to Maintain Growth

Ambitious small business owners, tired of relying on bank loans or waiting months for big customers to pay bills, are increasingly turning to innovative digital solutions that tap into the power of their invoices to unlock capital and pursue growth.

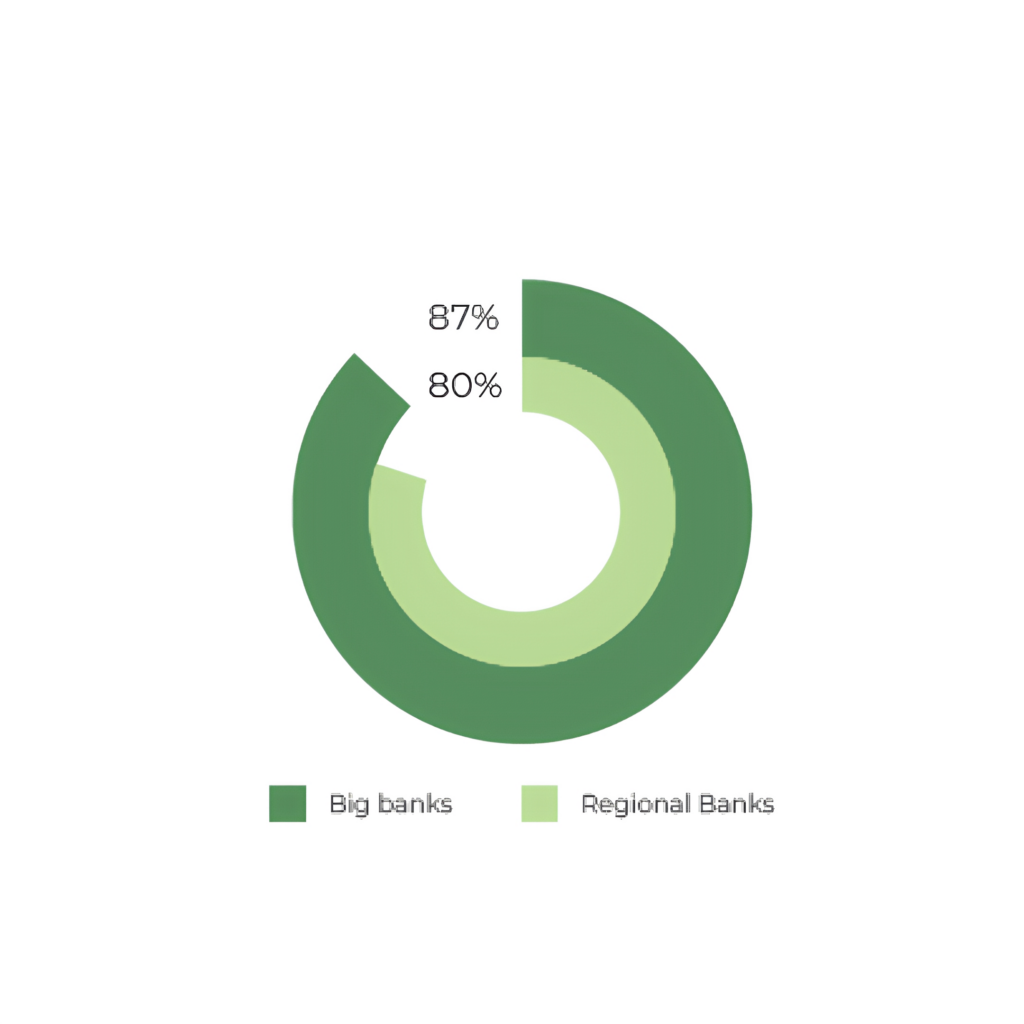

Amid a tight credit market, regional banks reject 80% of loan applications from small- and medium-sized businesses (SMBs), while big banks turn down 87%. This challenge for SMBs has resulted in a growing adoption of Accounts Receivable Finance (ARF) to optimize working capital.1

Even business owners who can secure bank loans, are keen to access more cost-effective flexible working capital finance solutions, which can enable them to grow without loading their balance sheets with debt, and to access capital as and when they need it.

SMB owners also increasingly expect the same type of streamlined, fast and secure digital financial products in their business lives that they have grown used to accessing daily as consumers, where ‘tap-and-go’ instant payments, cardless transactions and rapid funding approvals are the norm.

Raistone, one of the world’s leading and fastest growing fintechs, is a pioneer in Accounts Receivable Finance, delivering billions of dollars of working capital each year to businesses of all sizes across a wide range of industry sectors. It is backed by major institutional investors that include a full-service broker dealer, a $30 billion family office, a $900 billion wealth manager and an international bank.

It has a strong entrepreneurial culture and its own remarkable growth story, having more than doubled in size every year since operations began in 2017. Its achievement in growing by 3,768% from 2019 to 2022 earned it a top 50 place (it ranked 43rd) in the 2023 Deloitte Fast 500, which showcases the 500 fastest-growing companies across North America in key industries, including finance and technology

Raistone at a Glance

Raistone is one of the world’s leading and fastest growing fintechs

- Backed by major institutional investors

- 3768% growth from 2019 to 2022

- Ranked 43rd Deloitte Fast 500 (2023)

A Different Approach to Risk

Raistone’s sophisticated systems enable it to gain a detailed understanding of the financial strength and payment trends of a business. Also, as its financing is fully integrated with mainstream accounting and invoicing systems used by clients, decisions on advancing payments against outstanding invoices are based on timely and accurate data.

It looks at the bigger picture, taking account of the credit rating of the customers of a small business, which can include highly-rated global corporations. This allows Raistone to analyze and assess credit risk in a systematic and detailed way, leading to swift, well-informed and transparent decisions.

This contrasts with prevailing views by many banks, which consider small businesses in general to be bigger credit risks than larger ones.

Accounts Receivable Finance involves businesses obtaining advance payments from Raistone of up to 100% of the value of outstanding invoices for goods or services provided without having to wait until customers pay their bills, which can take months, depending on payment terms. Raistone then collects funds in a dedicated account when the customer pays.

“Working capital is needed every day to buy stock, pay wages, fund investment in new products or acquisitions or to enter new markets. Digital flexible solutions that don’t require taking on debt are helping level the playing field for small business owners who make such a vital contribution to economic growth,” says Andrew Baxter, Head of Product at Raistone.

“Everything we do is driven by a passionate belief that all businesses should be able to access the capital they need to manage and grow easily and quickly without having to wait months for customers to settle invoices.”

— Andrew Baxter – Raistone Head of Product

SMBs Face Working Capital Squeeze

Rising use of innovative working capital finance solutions and the emergence of new partnerships to deliver them, could not come at a more opportune time for SMBs, many of which have historically turned to regional bank loans as their default funding solution. They now find cashflow constrained – and with fewer than one-in-five loans being approved, they need to consider alternative options.

A nationwide Goldman Sachs survey, 10,000 Small Business Voices, found that 78% of small business owners were concerned about their ability to access capital.

An overwhelming majority (85%) said that if access to capital were to continue to tighten it would impact their growth forecasts and, of these, 67% said it would bring expansion plans to a halt.

The survey highlighted concerns among minority-owned business enterprises (MBEs). Black small business owners are statistically more likely to apply for business loans but also less likely to receive full bank funding requests than white peers.2

Raistone sees firsthand the cash-related struggles that minority-owned businesses in the supply chain face. That’s why the company waives enrollment fees for minority- and women-owned businesses with its “Empower by Raistone” program.

Mastercard Virtual Card Collaboration Accelerates Payment

Raistone and Mastercard have a long-standing partnership to accelerate working capital payments for SMBs by using virtual cards (vCards).

Virtual cards are all about speed, security, simplicity and convenience. The technology leverages unique single-use and randomly-generated digital numbers, which means no physical card is involved. Use of the technology is expanding rapidly: a new study by Juniper Research forecasts that the total volume of global vCard transactions will rise from 36 billion in 2023 to reach 175 billion by 2028.3

By leveraging Mastercard’s technology, Raistone’s virtual card program is being deployed directly to SMBs as well as integrated into customer-facing software provided by Raistone’s large enterprise partners. A key advantage to SMBs is rapid sign-up through their existing platforms, enabling businesses to drastically reduce their operational burden and get paid in a matter of days.

Businesses receive a unique vCard for each invoice financed with Raistone and each vCard has its own number, expiration date, credit limit and security code, helping to prevent fraud. An added benefit of using the vCard program is that if offers potential for businesses who meet the required criteria to accelerate payment even before customers have approved invoices.

Digital Financial Tools Can Boost Diversity and Inclusion

Raistone’s collaboration with Mastercard leverages vCards to advance an embedded finance experience and speed up working capital disbursements for businesses. Our collaboration extends beyond democratizing working capital for suppliers and small businesses, but also pushes even further around financial inclusion. Raistone has launched a program that has no enrollment fees for minority- and women-owned business enterprises (MWBEs), the initiative is specifically designed to promote diversity and inclusion by extending convenient financial tools to the companies that need them most.

“Integrating Mastercard’s virtual card technology into Raistone’s customer facing software improves cashflow for small- and-medium-sized businesses through quicker payments and simpler access to working capital. With a shared commitment to sustainable and inclusive growth, our activities directly benefit minority- and women-owned businesses, ensuring equitable access to solutions designed to boost liquidity and drive growth – ultimately providing entrepreneurs with a way to better manage and grow their business.” Rebecca Meeker, Senior Vice President, Global Partnerships & Segments.

There are 14 million women-owned small businesses in the United States, accounting for nearly 40% of all companies. According to the Women’s Small Business Ownership and Entrepreneurship Report for the US Senate, they generate $2.7 trillion in annual revenue and employ just over 12 million people.4

Businesses owned by Black and African American women make an important contribution in their own right, generating $98.3 billion in revenue and employing 528,000 workers, according to the 2023 Wells Fargo Impact of Women Owned Businesses report.5

Democratizing Access to Capital Pays Dividends

Research suggests that equal and rapid access to working capital could accelerate the revenue growth of minority- and women-owned business, helping to make the U.S. SMB sector a more level playing for all genders and ethnicities.

The Wells Fargo report estimates that collectively women-owned businesses in the United States have potential to generate close to $8 trillion additional revenue if the average revenue for women-owned businesses were to match that of firms owned by men.

It also estimates that businesses owned by women from minority backgrounds could generate an additional $667 billion revenue if their average revenue were to match that of companies owned by white women.6

Accounts Receivable Finance as a Tool for Growth

A common misconception about Accounts Receivable Finance is that it is mainly for distressed and cash-strapped small businesses with dwindling order books and few financing options to improve their cashflow.

Raistone has numerous examples of companies headed by ambitious business owners who view Accounts Receivable Finance as a vital part of their financial toolkit and an enabler of growth.

A key attraction for many is that it provides a cost-effective way to fund innovation and to bankroll planned and opportunistic growth, while retaining a strong balance sheet and maximum financial flexibility.

Access to working capital is crucial when companies need to scale up quickly to seize new growth opportunities. Fast growth may require making major inventory purchases, hiring or buying new equipment, recruiting fresh talent, opening new premises or funding a strategic acquisition – all of which requires capital to be on hand when it is needed.

Working Capital Solutions Deliver Tangible Results

Raistone clients span a range of industry sectors ranging from professional and financial services to sectors that tend to be more capital intensive such as renewables, engineering, construction, automotive, utilities, energy, retail and transportation and logistics.

Boujee LLC, a minority-owned design and manufacturing firm in the apparel and merchandising industry needed to combat lengthy payment terms. By working with Raistone, Boujee experienced 30x growth in three years.

Creative Construction, a woman-owned licensed general contractor, needed an injection of cashflow. After working with Raistone, Creative Construction took on 50% more projects and grew their revenue 2x.

Funding Small Business Vital to Maintain Economic Growth

The importance of providing America’s 33 million small businesses with access to affordable flexible working capital cannot be underestimated – nor can the important role small businesses play in helping the U.S. economy continue to grow despite challenging headwinds.

The economy chalked up 2.5% growth in 2023, defying expectations of a slowdown linked to the Federal Reserve’s policy of aggressively raising interest rates to historic 23-year highs and persistent worries about inflation and a tight jobs market.

Continued SMB financial resilience matters because small businesses account for roughly half of U.S. GDP, provide just under half of private sector jobs, are responsible for two-thirds of net new job creation and generate significant export revenue.

The U.S. Chamber of Commerce has warned that late payments to small businesses could derail growth unless solutions are implemented. In 2023 it launched a Prompt Pay Pledge initiative to persuade large companies to commit to paying small business suppliers and vendors faster. “If the small business economic engine sputters, so does the national economy,” wrote Thomas M. Sullivan, Vice President of Small Business Policy.

While persuading big enterprises to pay invoices promptly is a laudable objective, it puts small business owners in the uncomfortable position of being dependent on large companies’ goodwill to commit to pay on time or shorten payment terms.

By contrast, small business can take power into their own hands by using Accounts Receivable Financing to access capital long before a big customer pays an invoice, without the need to petition for better terms or chase important clients over late payments.

Amid an economic outlook still clouded by uncertainty, forward-thinking SMB owners are demonstrating an increasingly astute appreciation of how digital working capital finance tools can help fund growth.

REFERENCES

1. https://www.biz2credit.com/small-business-lending-index/november-2023

6. https://stories.wf.com/iwob/

Related Topics

Download your

free copy of our whitepaper

Fill out this form, and you will receive access to the full PDF of “Small Businesses Turning to Working Capital Finance to Fund Growth”