Non-debt working capital

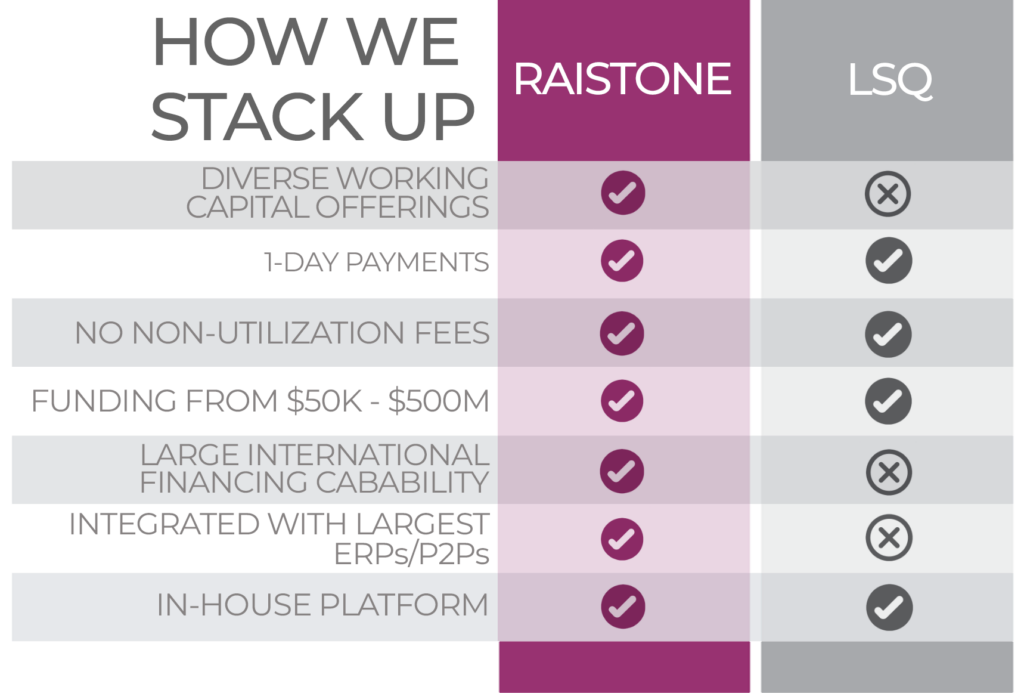

More Flexible Funding Than LSQ

Raistone’s cutting-edge technology provides buyers and suppliers with robust and versatile financing solutions. Raistone’s varied services will allow you access to flexible payment terms, accelerated payments, and more. Our robust funding capacity provides you with the financial agility you need to remain competitive.