In today’s volatile business environment, senior finance leaders are under pressure to support growth while protecting financial flexibility and minimizing risk. But what if there was another option, one that strengthens the balance sheet without added liabilities or loss of control?

Accounts Receivable Finance (ARF) presents an alternative path and compelling opportunity for companies to unlock the value of their receivables and improve cash flow efficiency. Businesses can use ARF to accelerate cash flow, improve working capital, and reduce balance sheet constraints, all without compromising commercial relationships or operational agility.

The strategic value of Accounts Receivable Finance

Finance leaders know that liquidity is a key driver of business stability, having ready access to cash helps keep operations running smoothly.

ARF offers companies the ability to monetize outstanding invoices without taking on additional debt. By selling receivables at a small discount based on their buyer credit profile, businesses receive near-immediate liquidity, while the purchaser collects the face value of the receivable at maturity.

The structure of ARF mirrors a zero-coupon bond, where funds are raised below par value and repaid in full at maturity. Unlike bond issuance or conventional loans, ARF does not create a liability on the balance sheet.

ARF is ideal for businesses managing uneven cash flows, supply chain delays, or rapid growth. In addition to improving metrics like days sales outstanding (DSO), ARF offers companies the flexibility to extend payment terms with their buyers while keeping operations fully funded.

ARF also serves as a strategic risk management tool for a supplier. Once their buyer accepts the invoice and the receivable is created, the risk profile of the asset transitions from supplier performance risk to buyer credit risk. Through ARF, the supplier effectively transfers that buyer credit risk to the purchaser of the receivable, removing their exposure to buyer insolvency risk.

Well-structured ARF programs create clear ownership and cash flow pathways, ensuring that once receivables are sold, payment flows directly from the buyer to the purchaser, which reduces operational burden and accelerates cash realization for the supplier.

ARF offers flexibility that traditional bank financing generally lacks. It can be scaled up or down based on demand, tailored to specific receivables or buyers, and optimized for cost. Suppliers retain control of the terms, relationships, and funding cycles and can position ARF as a precision tool in the broader capital allocation strategy.

Ultimately, when the cost of ARF is lower than the supplier’s weighted average cost of capital (WACC), it creates a net-positive return for the business. Understanding how ARF fits into the broader cost of capital framework is essential for CFOs evaluating capital deployment strategies.

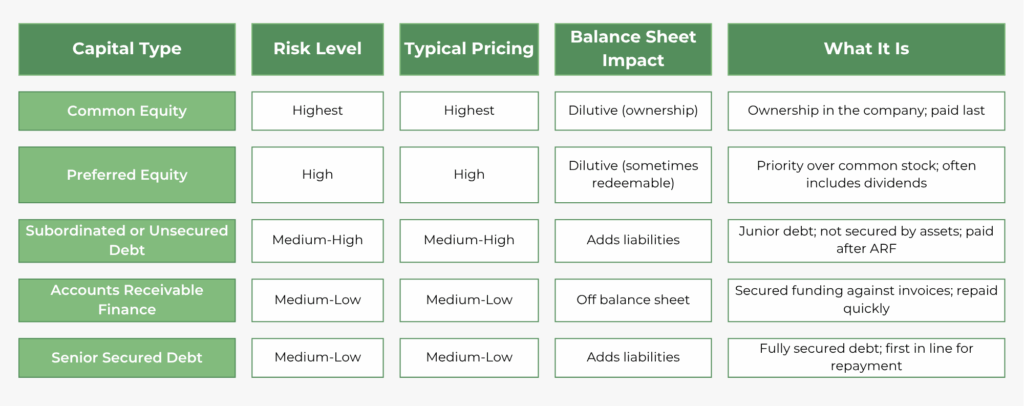

Here’s how ARF compares to other capital sources, offering a unique balance of liquidity, cost, and risk without the typical tradeoffs of debt or equity:

ARF market opportunities and pricing

An estimated $5.3 trillion of U.S. annual procurement spending is available for financing, translating to nearly $900 billion of accounts receivable eligible for financing on any given day.

Despite the scale of the opportunity, lack of sufficient access to capital remains a barrier. According to the National Small Business Association (NSBA), more than a third of small businesses lack adequate access to financing, often relying on credit cards or short-term loans while overlooking the value locked in their receivables.

Suppliers working with quality buyers can access competitive terms, with annual rates ranging between 9% and 18%, dependent on facility structure. ARF through Raistone is accessible to companies with a receivables base of $250,000 or more with a single buyer, making it a viable solution for a broad range of mid-sized and growth-oriented businesses.

Understanding the cost of funds and its implications on financial planning is essential when integrating ARF into corporate finance strategies.

Structural impacts on pricing

Several key factors impact the cost and availability of financing, including the quality and reliability of receivables and buyers, the positioning of receivables in the creditor hierarchy, the collection mechanisms in place, and whether the structure is disclosed to the buyer.

- Credit quality: The better credit quality of the buyer, the lower the pricing

- Lien Position: First-position liens provide better pricing

- Invoice Approval: Confirmation from buyer that the receivable is due and payable on maturity date

- Collection: Direct collection from buyer at time of invoice maturity

- Disclosed vs. Undisclosed: Notification structure impacts available rates, with disclosed programs getting more favorable pricing

- Remittance: Ideally two or more years of remittance history with the buyer

Case Study: Boujee, LLC

Boujee, a fast-growing, minority-owned apparel company, faced major cash flow challenges due to extended payment terms from large retailers. Waiting over six months for payment strained operations and limited their growth opportunities.

By partnering with Raistone and leveraging ARF, Boujee accelerated payment on invoices, freeing up working capital in days instead of months. As a result, they doubled sales within two years and projected a 30x increase in business within three years.

Raistone helped Boujee access the liquidity they needed, without debt or dilution, and has since increased their facility size to $2 million.

Reframing capital strategy with ARF

Accounts Receivable Finance represents more than a liquidity solution, it’s a strategic tool for improving capital efficiency. By unlocking capital tied up in receivables, suppliers can drive investment, fund operations, and protect against volatility without increasing debt.

CFOs and senior finance leaders are turning to scalable, flexible solutions like ARF to align capital strategy with broader business objectives. Raistone delivers tailored programs that support this shift, helping companies strengthen balance sheets and unlock value across the enterprise.

If you’re interested in learning about how Raistone’s non-debt solutions can help your business grow, call 888-626-6593 or fill out this form.

About the author

Kellen Bates serves as a Vice President on the ARF Originations team at Raistone. He manages ARF programs across a wide portfolio of clients and is responsible for onboarding new clients and growing existing relationships. Prior to joining Raistone, he served as a Procurement Agent at Boeing where he managed relationships between raw materials suppliers and Boeing. While there, Kellen learned the importance of capital access for smaller suppliers working with large organizations utilizing extended payment terms. He holds a Bachelor of Science in Finance from Montana State University and is a CFA® charterholder.

Related Topics