Full-stack working capital finance solution

Raistone Platform Solutions

Raistone provides technology and asset administration to institutional investors, enabling their access to the sought-after receivables and payables asset class.

Full-stack working capital finance solution

Raistone Platform Solutions

Raistone provides technology and asset administration to institutional investors, enabling their access to the sought-after receivables and payables asset class.

Large asset managers and hedge funds increasingly recognize working capital finance as a lucrative, low-risk asset class that offers consistent returns and diversification benefits. However, effectively managing trade finance programs poses significant challenges that these institutions often struggle to address.

Raistone Platform Solutions (RPS) is a comprehensive and customizable working capital finance back-office suite of technology and supporting services that empower institutional investors to quickly implement working capital solutions for their customers.

RPS is designed to streamline working capital finance operations by utilizing Raistone’s legal framework, technology, operations, and risk management. It reduces the investor’s overhead costs, shortens the time to revenue generation, and offers a scalable and flexible solution for their customers.

Win new business: Offer an expanded suite of solutions beyond just capital.

Reduce risks: Minimize credit and fraud risks with advanced risk management tools.

Cost efficiency: Lower costs for structuring, legal, and operations.

Faster time to revenue: Accelerate revenue generation with streamlined processes.

Scalability: Eliminate scalability constraints and optimize operations.

Tax efficiency: Optimize taxation and disclosure preferences.

Global network and coverage: Operation in multiple jurisdictions.

From invoice verification to legal templates, our platform covers all your needs.

Access expertise in working capital finance regulations and compliance.

Designed to grow with your business.

RPS delivers critical risk management capabilities — including comprehensive Know Your Customer (KYC), Anti-Money Laundering (AML), and Office of Foreign Assets Control (OFAC) checks — to ensure compliance and mitigate counterparty risk.

The service also extends to negotiating supplier legal documents, such as Receivables Purchase Agreements (RPAs), which may be required by certain investors participating in a program. These functions help address risk management deficiencies that often arise when investors lack access to dedicated working capital finance expertise.

A robust risk framework, with clearly defined documentation requirements and waiver procedures for instances where a participant chooses to proceed despite incomplete disclosures, is essential.

Employing industry-standard legal frameworks facilitates true sale, lowers legal costs, and accelerates the closing process

SPV compartments isolate assets and cash flows, and provide tax advantaged asset acquisition

AML, Sanctions, and KYC support confirm counterparties

Multi-modal payments including EFT and Virtual Cards

Reconciliation process verifies the accuracy of trading activity by comparing records and resolving discrepancies

Collections and workouts

Web-based user experience for buyers, suppliers and investors

Online or downloadable daily reporting

APIs to sources of receivable and receivable verification data

Access to independently verifiable receivables data reduces risk

Transactions flow through a third-party collateral agent

Lien searching, filing and maintenance

Raistone was born with the vision of equalizing access to working capital and meeting the demand for structured finance on a global scale. As a world leading fintech, Raistone enables the financing of billions of dollars in transactions every year.

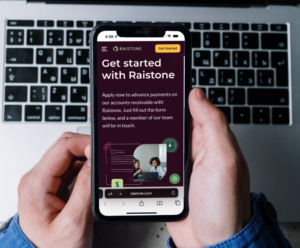

Tell us a little more about yourself and your business, and someone from our team will be in touch.