Author: Dave Skirzenski

I have spent the majority of my 30-year professional career solving problems related to the procurement, invoicing, payment and financing of global supply chains.

One of my primary motivations was to reduce the friction that businesses of all sizes experienced when it came to accessing working capital. Over the years, I’ve learned from countless clients and business partners – be they the buyer, supplier or financial institution – about what they seek in an optimal solution.

With Raistone Capital, we’ve created something special, something that addresses real needs and something that will have a long-lasting benefit for businesses and their partners up and down the supply chain.

But first, let’s talk about the working capital finance industry and how it has changed over the years.

The History of Working Capital Finance Impacts Us Today

Working capital finance is certainly nothing new. While this won’t be a history lesson, accounts receivable financing originated some 4,000 years ago during the era of King Hammurabi of Mesopotamia. In fact, our company name has a historical component as, for centuries, Rai stones were used as currency for contracts, economic transactions and trade. Working capital finance – where a business sells its receivables to a third party in order to get cash on hand sooner – has remained relatively unchanged since Hammurabi. What has changed, and rather dramatically, is how this market has evolved due to (unfavorable) regulatory changes, shifting consumer behavior and advances in technology.

Demand for supply chain financing, a form of working capital finance sponsored by large corporates, has seen rapid growth in the last decade and it shows no sign of abating.

In many ways, it is the perfect storm of opportunity that brought us to this point. The Great Recession and economic collapse that began in December 2007 led to banks being much more restrictive with their business lending practices. In December 2011, according to NBC News, lending to small businesses hit a 12-year low.

Knowing that businesses were still looking to secure capital to fund their operations (combined with increased comfort in conducting business transactions online), non-bank financing opportunities emerged. At the same time, large corporates were extending payment terms (doubling over the last 10 years, with 90, 120 and even 180 days becoming common).

The Rise of Supply Chain Financing

Demand for supply chain financing, a form of working capital finance sponsored by large corporates, has seen rapid growth in the last decade and it shows no sign of abating, this according to experts like Federico Caniato, professor at the Polytechnic University of Milan. In fact, he told Supply Chain Management Review earlier this year that he saw supply chain financing rising for the next few years as trade barriers emerge and interest rates rise. Because of this, he says, “no one can take available liquidity for granted.”

And with the value of outstanding invoices in the U.S. at any given time exceeds $2.7 trillion (or around 13 percent of GDP), there is seemingly no shortage of opportunities.

A New Industry Emerges

Over the last decade, factoring firms, dynamic discounting companies, marketplace lenders and other providers of non-bank financing surfaced, helping businesses to secure hundreds of billions in working capital – much of it through on-line tech platforms.

Filling the Gap for Businesses

But there remains a gap in the market in terms of the dollar amount these fintechs were making available, and it was often at very high interest rates or low advance rates.

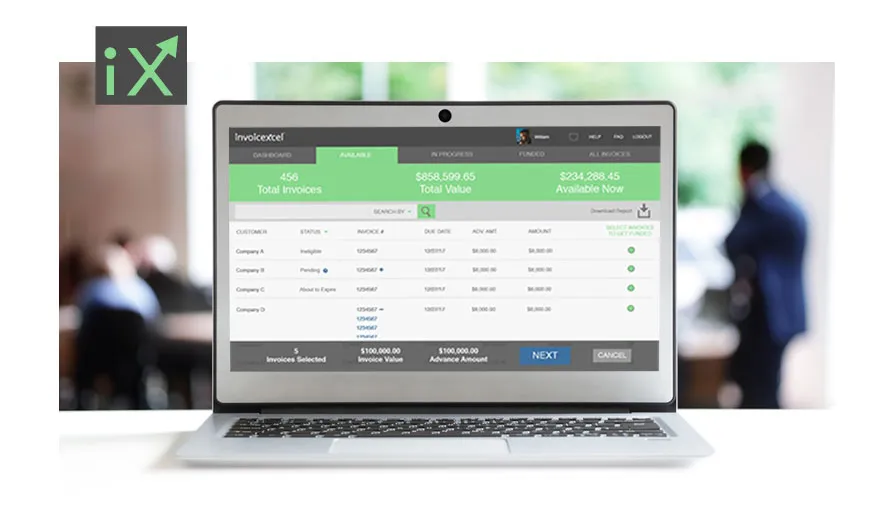

This is where invoiceXcel comes in. invoiceXcel (iX) is Raistone Capital’s proprietary receivables finance product that benefits suppliers, their customers and financial institutions by offering a cost effective early payment solution.

iX is an easy to use online platform that allows suppliers to be paid in advance of the invoice due date; financing invoices, purchase orders and inventory. We offer this service to suppliers with invoices ranging from $50,000 – $300 million+.

Many in the fintech space see $50,000 as their high end while banks typically won’t consider anything under $25 million. This means we can cost effectively help suppliers take on more sales within hours of submitting their invoices on our platform.

Because of our affiliation with Seaport Global, a full-service independent investment bank and broker dealer, we have unmatched access to the capital markets (as well as to banks) to create flexibility, span the credit spectrum and reduce friction cost for the suppliers.

iX Offers an Unprecedented Value That Enables Growth

Unlike others in the industry, iX frequently offers a 100% advance rate, seamlessly co-exists with the supplier’s existing lending facilities and offers options to the supplier to not disclose the transaction to their customers. Advancing 100% of a receivable (minus the initial discount) has a transformative effect on suppliers because it helps them grow without needing additional equity or debt, even if orders double or triple.

We see iX as a total market solution.

Large corporates can offer it to their suppliers to secure their entire supply chain.

Banks, who want to expand their offerings without taking on additional risk, but who also want to keep these customers “in the family” are able to offer iX as a white label service to their customer base. Institutional investors who are seeking entrance to the working capital finance space have found iX an easy way to deploy their balance sheets.

Technology companies like ERPs, eInvoicing platforms or procurement services offer iX to their clients with a turnkey working capital solution that offers incremental revenue opportunities – effectively, transforming the techs into fintechs. Much like how Amazon Web Services is able to offer a robust, outsourced tech platform for companies, we at Raistone believe we’ve developed the “go to” platform for Finance as a Service.

We’re Re-Engineering Structured Working Capital Finance

I’ve seen a lot and certainly learned a lot in my years working in working capital finance. Every step of the way, I’ve looked to build and enable better opportunities for clients and business partners.

The same is true for the rest of the team at Raistone Capital.

We all came together to fundamentally re-engineer structured working capital finance. With iX, we’ve done exactly that. We could not be more pleased or proud of our success to date.

To learn more about how Raistone Capital can help you, feel free to drop us a line at Media@raistonecapital.com. I’d love to hear from you.

Sources

https://www.entrepreneur.com/article/285233

https://www.nbcnews.com/business/markets/bank-loans-small-business-fall-12-year-low-flna1C7101049

https://www.ft.com/content/4610e820-1b09-11e9-9e64-d150b3105d21

https://smallbiztrends.com/2013/04/invoice-factoring-growth.html

https://www.scmr.com/article/7_supply_chain_financing_trends_to_watch_in_2019

https://www.investopedia.com/articles/economics/10/understanding-basel-3-regulations.asp