In the upstream and midstream oil and gas sectors, operators rely heavily on oilfield service providers (OFSPs) to deliver the specialized labor, equipment, and expertise required to keep energy production and transportation running efficiently. Whether it’s drilling and well completion for upstream exploration and production (E&P) companies, or pipeline construction and maintenance for midstream operators, OFSPs are essential to the energy value chain.

Despite their critical role, these service providers often face significant cash flow challenges due to slow and complex payment processes. While digital tools have improved operational workflows, the financial side of the business remains outdated. Fortunately, supplier-initiated payments, like the program offered by Raistone, provide a scalable solution to improve liquidity, reduce friction, and strengthen relationships across the supply chain.

Oil and gas industry payment processes

For OFSPs operating in the upstream energy sector, delayed payments are a structural challenge that limits growth and stresses working capital. These companies must cover payroll, equipment, and materials long before they’re paid.

While digitization has improved operational workflows, the financial processes tied to payment remain slow and inflexible. Many OFSPs still wait months to get paid, with few options for early access to cash.

Field ticket approvals

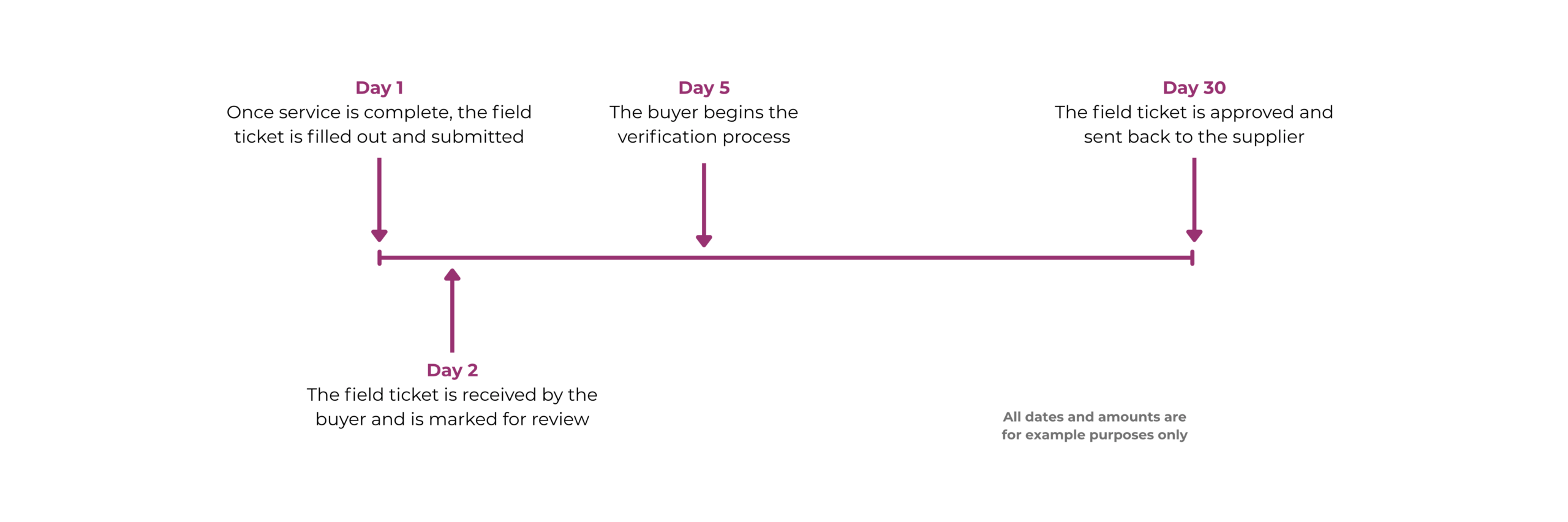

For OFSPs, the path to payment begins at the wellsite or pipeline project, not in the back office. After completing a job, crews document services performed, equipment used, and materials consumed in a field ticket.

If everything aligns, the ticket is approved. But if there are discrepancies — such as missing signatures, unlogged hours, or mismatched service descriptions — the ticket may be rejected or delayed. In manual systems, this approval process can take 5 to 30 days. Even with digital tools, delays persist due to internal workflows and job complexity.

Invoice approvals

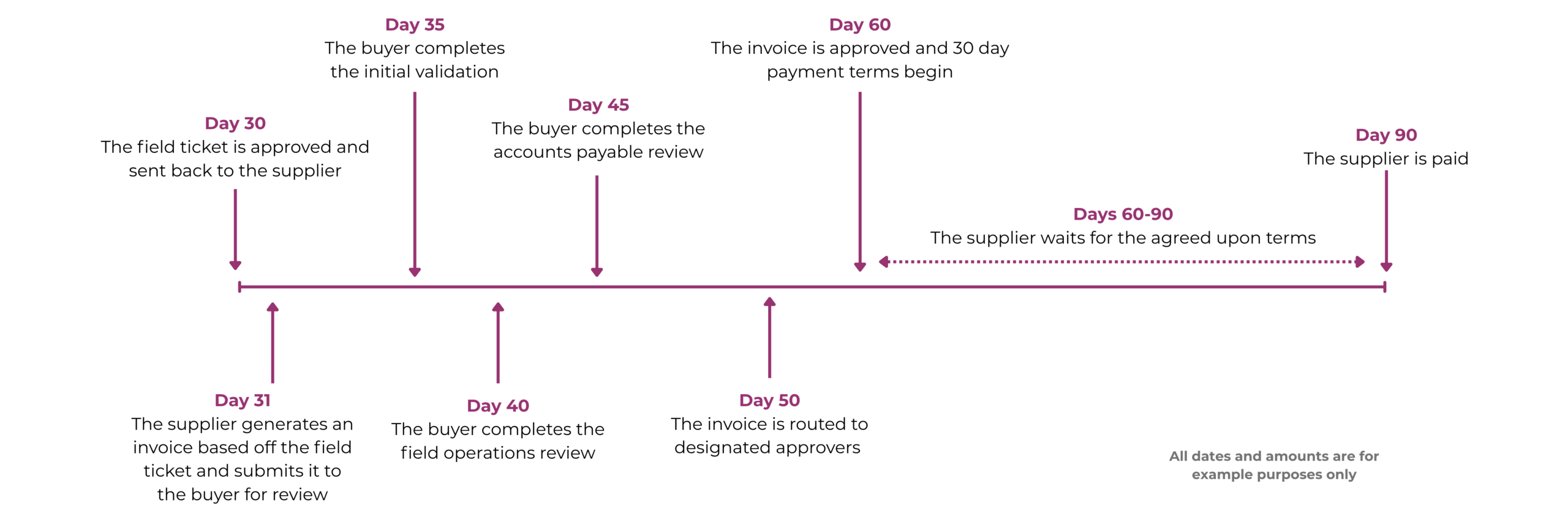

Once the field ticket is approved, the OFSP can generate an invoice. But this introduces a second layer of review. Invoices are validated, cross-referenced with field tickets and purchase orders, and routed through multiple layers of approval, especially for large or complex jobs.

It most cases, payment terms don’t begin until invoice approval, which can be weeks if not months after the job has been performed. It’s not uncommon for OFSPs to wait 60 to 90+ days from job completion to payment.

Digital field ticketing

To address inefficiencies in the payment process, many oilfield service providers have adopted electronic field ticket (EFT) systems. These platforms digitize the ticketing and invoicing process, enabling real-time ticket submission and approval, as well as faster invoice generation and validation, while reducing errors and disputes.

By implementing EFTs, OFSPs can reduce the time between job completion and invoice submission, helping to accelerate the overall payment cycle.

Top providers of digital field ticketing solutions include OpenTicket by Enverus, FieldEquip, Quorum Software, and P2 Energy Solutions.

Current trade finance solutions in the oil and gas industry

In an industry where billions of dollars flow through complex, project-based ecosystems, you might expect trade finance to be a reliable safety net for suppliers. But for many oilfield service providers, especially small- and mid-sized firms, that’s not the case.

While Supply Chain Finance (SCF) and other trade finance tools are an option for some, there can be limitations in the scope through onboarding requirements, contracting information, and other variables. More traditional programs generally provide funding after the invoice has been approved by the buyer. This means that OFSPs still wait through the entire field ticket and invoice approval process before they can access payment, so the cash flow gap remains significant.

Many OFSPs are excluded from these programs altogether, despite being essential to operations. This strains supplier relationships and introduces operational risk for energy companies that depend on these vendors to keep projects on track.

Evaluation of industry leaders

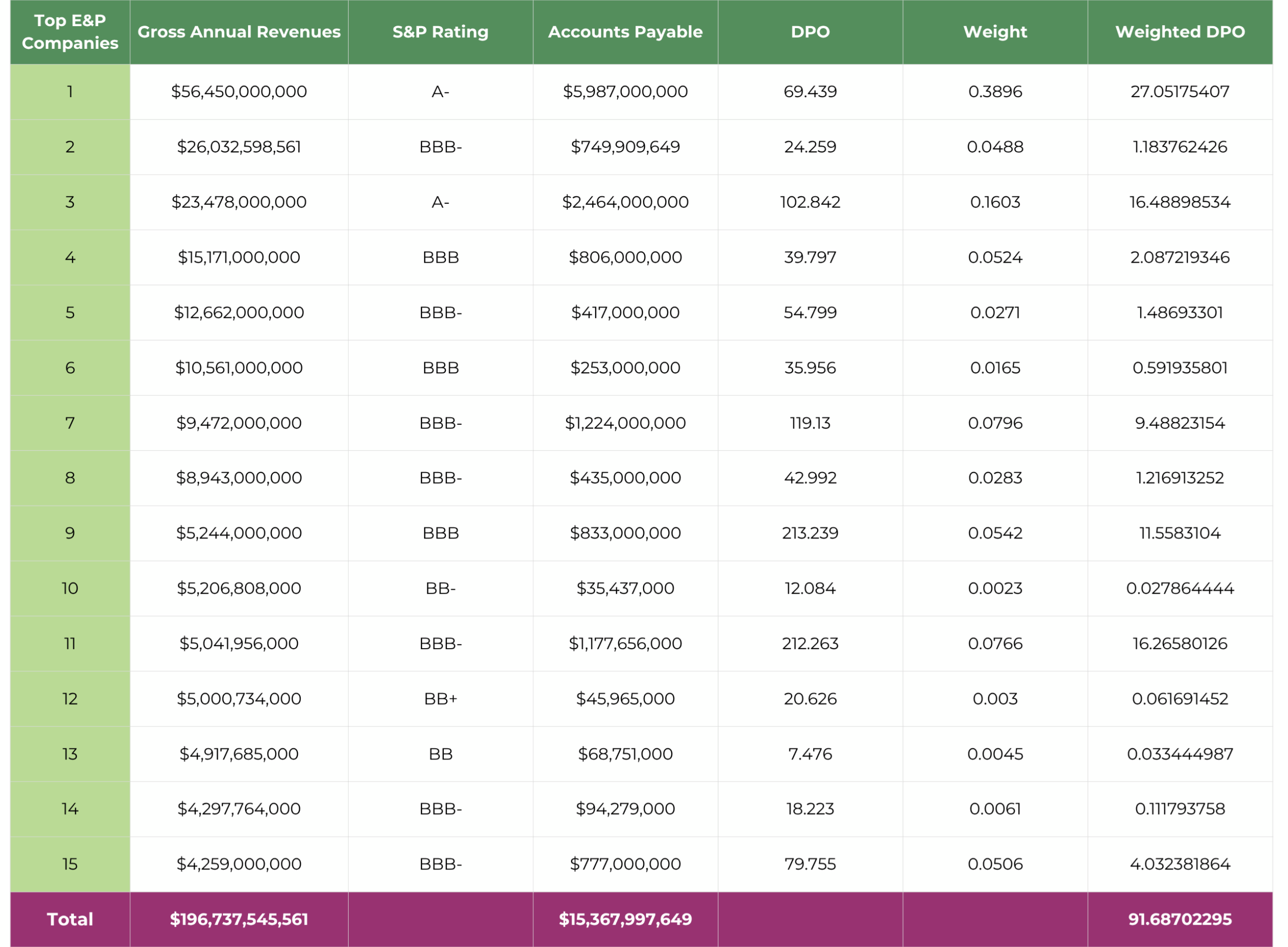

Based on the financials from the top 15 pure-play E&P companies, there’s over $15 billion tied up in accounts payable with a weighted average DPO of 91 days.

While not all of this is owed to OFSPs, a significant portion represents unpaid invoices for critical services rendered in the field.

These invoices are backed by investment-grade debtors, meaning they could be converted into cash with rates that may be lower than traditional lending options, such as asset-based loans. By unlocking just a fraction of this capital, OFSPs could significantly improve liquidity and reduce reliance on high-cost financing.

How supplier-initiated payments help oilfield services providers

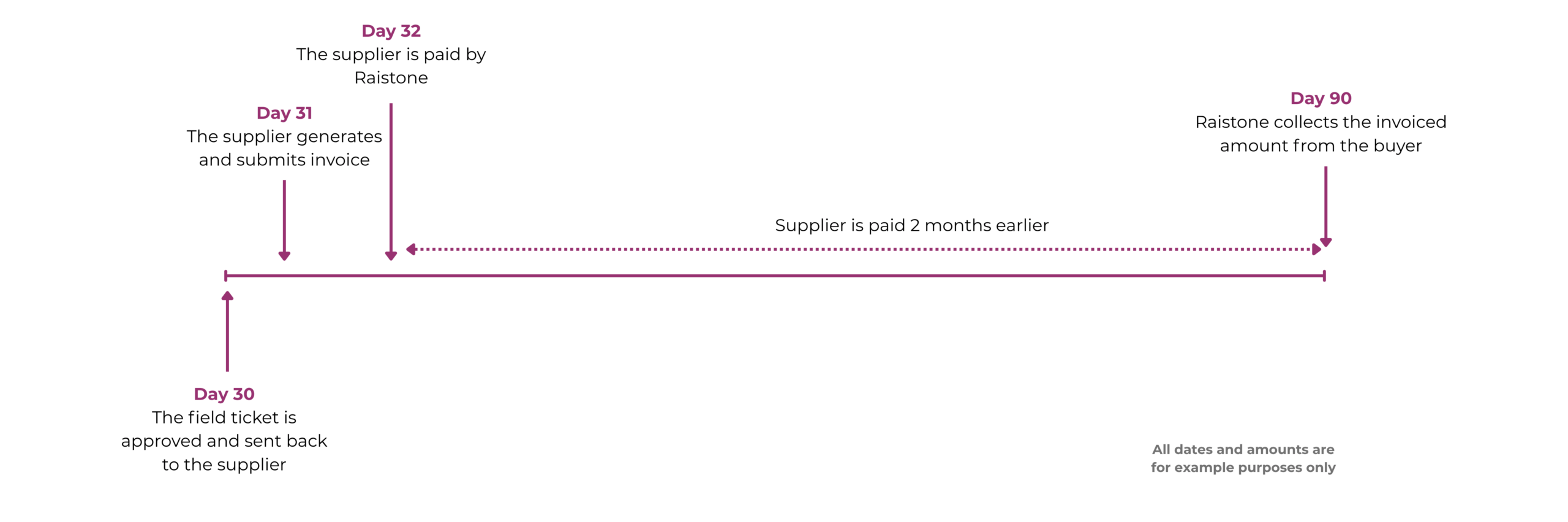

The Raistone supplier-initiated payment is groundbreaking for OFSPs, giving them control over their cash flow to address this payment gap.

This program allows for funding at invoice generation, versus invoice approval, so OFSPs can access working capital weeks earlier than traditional payment cycles.

Plus, the program operates independently of the upstream or midstream customer — meaning suppliers don’t have to worry about buyer involvement with enrollment or approvals — while still providing financing based on the buyer’s credit rating for more competitive rates.

This approach complements recent improvements in field ticket and invoice workflows, as Raistone offers OFSPs a seamless way to accelerate payments and improve financial resilience.

Providing critical payments for critical work

For OFSPs, the backbone of upstream and midstream operations, access to working capital is critical for growth. While digital tools have improved operational workflows, financial processes have lagged.

Fortunately, with Raistone’s supplier-initiated payment program, OFSPs can take control of their cash flow, unlock billions in working capital, and build stronger, more resilient businesses.

If you’re interested in learning more about how Raistone can help your company grow with supplier-initiated payments, call 888-626-6593 or fill out this form.

About the Author

Pete Kienlen, Sales Director at Raistone, leads efforts to develop tailored working capital solutions for clients. With over 20 years of experience in sales, finance, and global logistics — including more than a decade at American Express and Expeditors International — Pete specializes in helping businesses optimize cash flow, across multiple industries including energy, manufacturing, construction, retail, and logistics. Pete values Raistone’s agile environment, which enables quick, customized solutions, and is passionate about supporting small- and medium-sized businesses.

Related Topics

Insights, Accounts Receivable Finance, Supply Chain Finance, Blogs