Sections

Aftermarket automotive parts suppliers are getting squeezed.

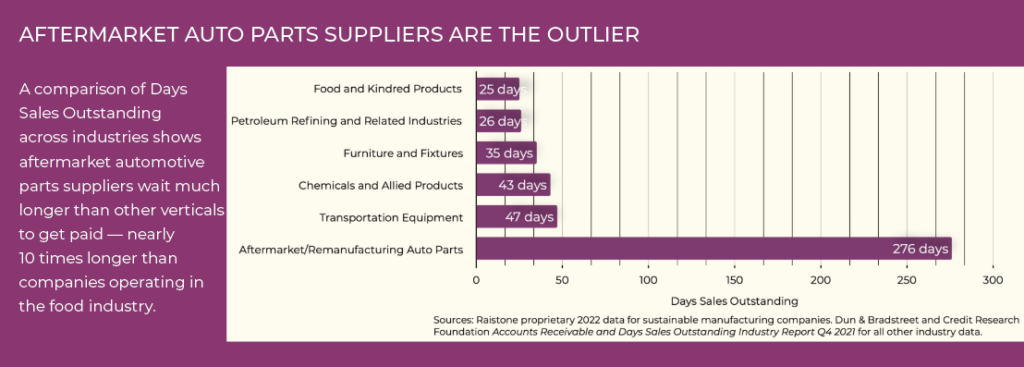

Since 2012, the average days sales outstanding for suppliers in the aftermarket auto parts space have grown by 37 days to 276 days, the latest data from Raistone reveals.

The aftermarket auto parts business has historically been one of the worst for delayed payments in the U.S. economy — and it is deteriorating even further. In some cases, suppliers have customers imposing terms over 360 days, and yet they must still pay their lower-tier suppliers in as little as 30 days, with the trend only worsening since the start of Covid.

Raistone data shows that one leading aftermarket retailer saw their average days payable outstanding (DPO) increase by more than 30 days between 2017 and 2020. This crunch creates a working capital gap that is expensive or even untenable for aftermarket suppliers to resolve.

In spite of this worsening crisis, many aftermarket auto suppliers have not been able to unlock the millions of dollars in working capital that is trapped on their balance sheets. By tapping working capital using established non-debt financial tools, companies can grow their business, invest in capital expenditures, issue dividends to investors, improve their capital adequacy ratios, pay down debt, make acquisitions, and much more.

Cash can be extracted from the balance sheet with a two-pronged approach:

- Accounts Receivable Finance (ARF), which allows aftermarket automotive parts suppliers to collect payment due from their customers early.

- Supply Chain Finance (SCF), which enables those same suppliers to extend their days payable outstanding while ensuring lower-tier suppliers can still be paid in a timely manner.

Why choose both Supply Chain Finance and Accounts Receivable Finance?

Consider this common scenario: An aftermarket supplier wins a new contract to sell its top product, fuel pumps, to a large auto parts retailer. The supplier’s revenue is about to jump, but traditional banking partners simply cannot keep up with the overnight surge in demand this new contract has brought on. The supplier then finds itself struggling to obtain the capital necessary to manufacture and ship the pumps.

This is where Accounts Receivable Finance and Supply Chain Finance can bridge the gap and ease the pressure on the fuel pump supplier.

Using Accounts Receivable Finance, the aftermarket supplier is able to accelerate payment due to them from the large auto parts retailer. Instead of waiting as long as 360 days for payment, they can receive settlement — with an advance rate of up to 100 percent— in as quickly as a few days or weeks.

Accounts Receivable Finance leverages the credit rating of the buyer of the fuel pump, the auto parts retailer. That means the fuel pump supplier is often able to access better pricing, as lenders are assessing the creditworthiness of the buyer, which will continue to pay at its regular 360-plus-day terms.

A select few providers of Accounts Receivable Finance are natively integrated with many of the largest business-to-business invoicing and payment platforms (ERPs) that suppliers already use, such as SAP Ariba or NetSuite. In this instance, through their ERP, the aftermarket fuel pump supplier can be onboarded in a matter of minutes, allowing them to accelerate payment on invoices due to them much faster than a bank could provide access to capital.

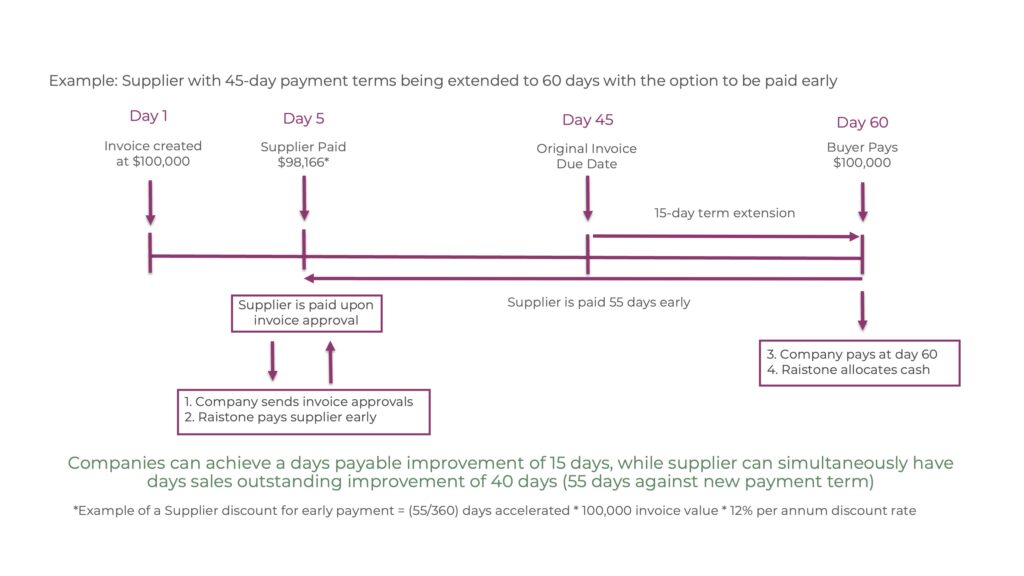

In addition, the supplier can choose to utilize Supply Chain Finance to extend their days payable outstanding to lower-tier suppliers. With Supply Chain Finance, the fuel pump maker extends its days payable outstanding from 60 days to 240 days, allowing them to retain more cash on their balance sheet to use as needed, including building more fuel pumps to meet the buyer’s demand. Meanwhile, the lender pays the lower-tier suppliers on their normal 60 days terms.

Both Accounts Receivable Finance and Supply Chain Finance are non-debt funding solutions that do not impact debt covenants. They are not loans and do not appear on the balance sheet. This means they can be complementary to traditional loans and other lending facilities, allowing aftermarket auto parts suppliers to diversify and tap into multiple sources of funding.

With this holistic two-pronged approach, the fuel pump supplier is able to free up hundreds of millions of dollars that would otherwise be locked up on their balance sheet.

How it works

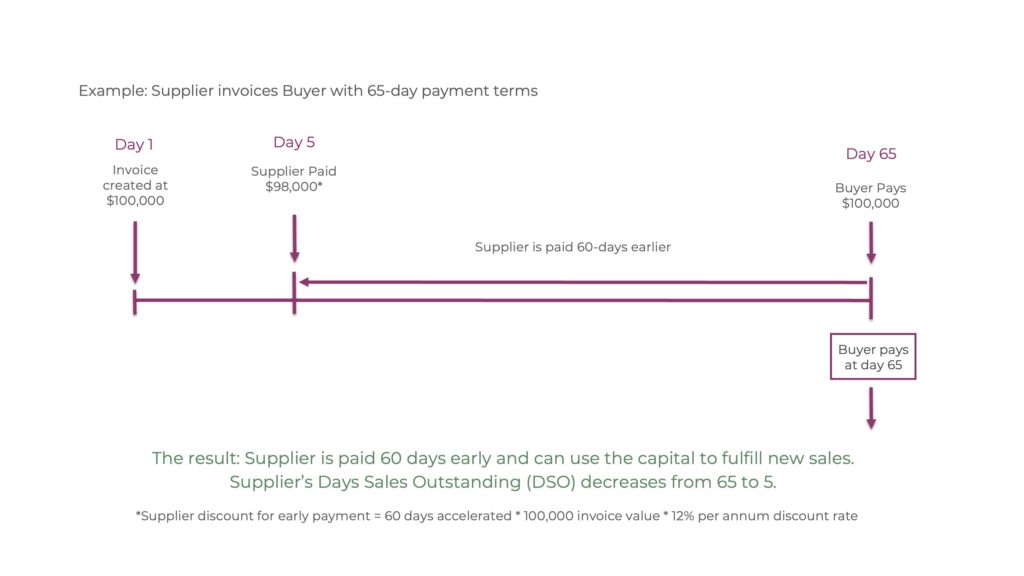

Accounts Receivable Finance is accelerated payment of invoices already due to a company. Rather than waiting 270 days — or even longer — to get paid, the company works with a financial firm, which arranges to purchase the value of the invoice and deliver that money, less a discount fee, to the company in as little as one business day.

The buyer, which initially made the purchase of goods or services, retains their payment terms. But instead of paying the supplier after 270-plus days, they will make payment to the financial firm that purchased the invoice. If the supplier does not want the buyer to know that the invoice has been sold to the financial firm, a simple of change of account notice will suffice to redirect the remittance to an account with the supplier’s name on it at the financial firm’s bank.

Accounts Receivable Finance is not a loan, so it is not subjected to, nor will it impact, a business’s credit rating or debt covenants. Instead, aftermarket automotive parts suppliers who take advantage of Accounts Receivable Finance get paid faster, with a much shorter application process, and no bureaucracy to contend with.

Supply Chain Finance is essentially the same process as Accounts Receivable Finance, but it is applied to the supplier’s lower-tier suppliers (the tier 1 aftermarket supplier is the buyer). With Supply Chain Finance, the tier 1 is purchasing goods or services from its supplier and is able to extend their payment terms, while the tier 2 supplier has the option to be paid in advance of the due date, less a discount fee.

Case study

By using accounts receivable finance and supply chain finance with Raistone, learn how an automotive parts manufacturer was able to unlock $296 million from their balance sheet, and grow their business with these funds.

A select number of fintech companies that specialize in both Supply Chain Finance and Accounts Receivable Finance work with investors to fund the payments of these receivables.

By leveraging the power of capital markets and the credit strength of buyers, fintech firms are able to drive down the price of this financing and deliver an efficient, holistic solution that frees up the supplier’s cash from its balance sheet.

Some fintech firms also offer native integration with enterprise resource planning (ERP) systems, from companies such as SAP, Oracle, Microsoft, Infor and many more. This makes it much easier for suppliers to apply for Accounts Receivable Finance, to submit their invoices for accelerated payment, and to receive prompt payment through either traditional wire transfer, or even faster solutions like virtual cards. The administration of a Supply Chain Finance program can also be facilitated if the parties use an ERP tool.

Most companies within the aftermarket automotive supply space are both buyers and suppliers, meaning they can take advantage of the convenience and cost savings of both Supply Chain Finance and Accounts Receivable Finance. This “double-barreled” financing approach empowers these companies to maximize their cash position while also ensuring the health and stability of their supply chain.

Though leading fintech firms have driven the use of Supply Chain Finance and Accounts Receivable Finance forward by bringing in new investors and partners to lower pricing, these solutions are not new, and have been provided by many financial institutions of all sizes for decades. It is an established, safe and secure way for businesses to access their money, on their terms.

Using both Supply Chain Finance and Accounts Receivable Finance, aftermarket automotive suppliers have collectively tapped into billions of dollars that would otherwise have been unavailable to them. These tools have allowed them to grow their business, take on more clients, make acquisitions, produce more products, hire additional personnel, buy equipment, pay dividends and much more.

Many companies within the automotive sector realize there is cash locked up in their balance sheet but struggle to gain access to that capital. At Raistone, we are solely focused on helping those companies tap into those funds. This enables them to grow their business, invest in capital expenditures, issue dividends to investors, improve their capital adequacy ratios, pay down debt, make acquisitions, and much more.

About the author

Mike Bruynesteyn is Chief Financial Officer of Raistone. He also serves on the board of one of the top automotive parts suppliers in the world.

Previously, he served the automotive industry as an investment banker. Prior, he was the senior sell-side research analyst for the automotive group at Prudential Securities. In that role, he received numerous awards for stock selection and research quality from publications such as The Wall Street Journal, Fortune, and Institutional Investor. Before joining Wall Street, Bruynesteyn spent eight years with General Motors, in overseas and domestic assignments spanning pricing, sales, budgets, capital planning, and investor relations.

Bruynesteyn graduated as a mechanical engineer from the University of British Columbia. He also earned a Master of Business Administration from the London Business School and studied at the Ecole Des Hautes Etudes Commerciales outside of Paris.

About Raistone

Raistone is a world-leading fintech, providing financial tools specially tailored to the needs of the automotive aftermarket sector. The company helps businesses accelerate payment of money due to them, through Accounts Receivable Finance, and gives companies control and flexibility over payment terms, through Supply Chain Finance. Since its inception in 2017, Raistone has provided billions of dollars of innovative financing solutions to a range of companies in the automotive aftermarket space. By working with Raistone, these suppliers have been able to unlock millions of dollars in working capital that was previously trapped on their respective balance sheets.

Related Topics

Insights, Accounts Receivable Finance, Supply Chain Finance, Whitepapers

Your free copy of Driving Growth

Fill out this form, and you will receive access to the full PDF of “Driving Growth.”