In this whitepaper, Raistone and Mastercard financial experts discuss how many small- and medium-sized businesses (SMBs) are turning to Accounts Receivable Finance (ARF) to optimize working capital amid a tight credit market.

Empower by Raistone

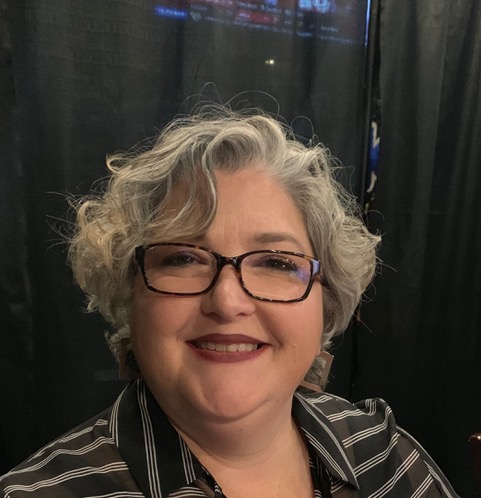

Equalizing Access to Capital

At Raistone, we understand that women-owned businesses remain vastly underrepresented and know that they have the potential to change the landscape of the economy. That’s why we’re proud to waive enrollment fees for women-owned business enterprises (WBEs).